We have already added in Malaysia GST tax codes Form 3 and General Audit File GAF to QuickBooks Online. Blogs tagged malaysia gst.

IM 6 GST on import of goods.

. Examples of zero-rated supply as prescribed based on tariff code in GST Zero-rated Supply Order 2014. In the Malaysia government website the GST tax type proposed is GST. No specific report layout has been introduced for Malaysia GST.

Secondly I notice the GST tax code listing have 2 3 or 4 characters however SAP standard provided 2 characters tax code only. Malaysia GST Reduced to Zero. GST Tax Code Table for Malaysia.

GST Tax Codes for Purchases GST code Rate Description TX 6 GST on purchases directly attributable to taxable supplies. Supply of goods and services made in Malaysia that accounted for standard rated GST. The following table shows the tax code properties required to correctly generate the Malaysia tax reports provided by the International Tax Reports SuiteApp and the Malaysia tax audit files provided by the Tax Audit Files SuiteApp.

GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

Malaysia GST Reduced to Zero. However I notice SAP use only A for output tax and V for input tax. The tax code names and letters presented in the table are suggested names or.

GST which was also known as a value added tax in other countries was implemented and. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. The tax codes list window displays all the GST codes available in MYOB.

Examples of zero-rated supply as prescribed based on tariff code in GST Zero-rated Supply Order 2014. Before values can be calculated and shown on reports you must specify a relevant sales tax reporting code for each tax code that is used in the sales tax payment. Goods Services Tax 0.

There are 23 tax codes in GST Malaysia and categories as below. 56 rows Input Tax 6 - GST incurred and choose not to claim the input tax. For more information regarding the change and guide please refer to.

The tax codes in italics are MYOB default tax codes and are not applicable to Malaysian GST. GST on import of goods. GST Tax Code for Purchase.

It applies to most goods and services. Write a Blog Post Close. GST Tax Codes Malaysia.

GST Tax Codes for Purchases. Purchases with GST incurred at 6 and directly attributable to taxable supplies. With one-click GST reports our small business customers save hours freeing up time to grow their business.

Segala maklumat sedia ada adalah untuk rujukan sahaja. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting. You need to fill in the fields as shown especially the tariff code default tax rate if your products are taxable.

The Standard-Rated SR code is for. Tax Code Maintenance Peter Tan. Overview of Goods and Services Tax GST in Malaysia.

Approved Trader Scheme ATMS Scheme. GST Tax Code Table for Malaysia. GST was only introduced in April 2015.

GST on purchases directly attributable to taxable supplies. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Mapping sales tax reporting codes to sales tax codes.

The two reduced SST rates are 6 and 5. Business Trends Event Information. Input Tax Not Claim ND.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. Explanation of Government Tax Codes For Purchases. 1 Government Tax Code.

We had two solutions on the able. SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system. Imports under special scheme with no GST incurred eg.

Configuring as a genuine non-deductible. This article relates to the Goods Services Tax which was introduced in April 2015 but was subsequently replaced with the Sales Service Tax in September 2018. Goods And Services Tax Malaysia TX.

You must use the Default report layout for your reporting codes. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. Hello everyone just to share one detail on the non-deductible tax code BL Purchases with GST incurred but not claimable Disallowance of Input Tax.

Charging GST at 0 the supply of goods and services if they export the goods out of Malaysia or the. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Import of goods with.

For more information regarding the change and guide please refer to. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. So should I create a new tax type GST for this purpose.

The access to the tax code list menu is the same for both MYOB Accounting and MYOB Premier. Purchases with GST incurred at 6 and directly attributable to taxable supplies. Goods And Services Tax Malaysia IM.

GST code Rate Description. We offer a free 30. Here is a list of tax codes that are available in MYOB Accounting v24 and MYOB Premier v19.

What is the GST treatment and tax code that need to be used for such supply. If your products are non. Malaysia GST Training 4.

Notice From Gst Department Top Reasons Response Timing Eztax In

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

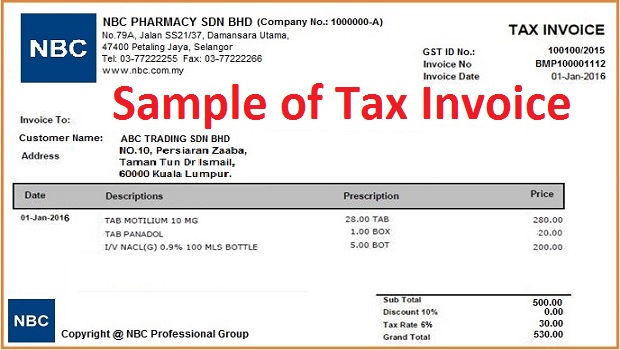

Tax Invoice Goods Services Tax Abss Accounting Malaysia

Complete Sst System Setup Guideline Help

Tax Codes In Myob Goods Services Tax Malaysia

Free Resources Archives Goods Services Tax Gst Malaysia Nbc Group

The Brief History Of Gst Goods And Service Tax

Goods And Services Tax Gst In Malaysia 3e Accounting

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

一起考cpa吧 Question 相信很多人对这个问题很困扰 Petrol 95 Diesel 的tax Code是zp 还是ep Answer The Retail Sales Of Petrol Ron 95 Diesel

Newsletter 9 2018 Amendment On Gst Tax Codes Page 002 Jpg

Tax Codes In Myob Goods Services Tax Malaysia

Goods And Services Tax Gst In Malaysia 3e Accounting